Navratri to Diwali bonanza on Dalal Street: Buying stocks has made investors richer in the last 10 years

Examining the sectoral indices, it is notable that BSE IT has been the only sector to record negative average returns over the past 10 years, while BSE Bankex has emerged as the top gainer with an average gain exceeding 5%.Further analysis reveals that between Navratri and Diwali, bank stocks have yielded positive returns in 7 out of 10 instances, while auto and consumer durables have performed well with positive returns in 8 and 9 out of 10 instances, respectively.

In terms of stock-specific performance, three companies – TVS Motors, VIP Industries, and Petronet LNG – have consistently provided positive returns during the festive season over the past 10 years, the report said. TVS Motors has achieved an average return of 14%, VIP Industries 8.6%, and Petronet LNG 6.6% in the last 10 years.

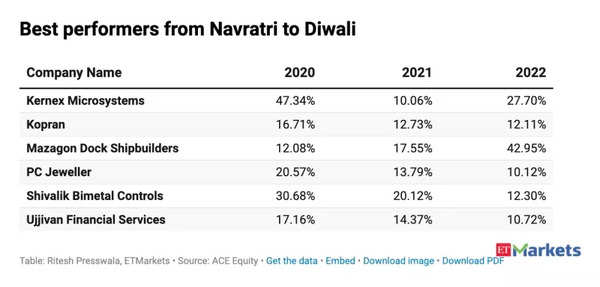

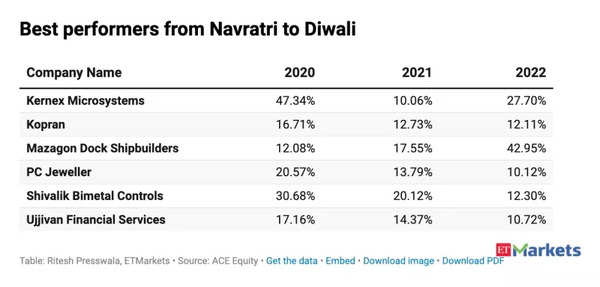

Best stock performers from Navratri to Diwali

Narrowing down to the past 3 years, six stocks – Kernex Microsystems, Kopran, Mazagon Dock Shipbuilders, PC Jeweller, Shivalik Bimetal Controls, and Ujjivan Financial Services – have consistently delivered double-digit returns.

Diwali 2023: What should Dalal Street investors do?

Looking ahead, investors are advised to adopt a bullish approach. Wall Street expects interest rates to reach their peak, while the domestic market has witnessed earnings in line with expectations. Fitch’s upward revision of India’s mid-term GDP growth forecast to 6.2% has also added to the optimism. Sectors such as consumer durables, realty, and auto are currently in focus, emphasizing the growing consumption story in the economy.

Atul Parakh, CEO of Bigul, advises short-term traders to hedge their positions to mitigate global volatility. “Indian markets will be under the grip of extreme volatility amid global market weakness, rising inflation pressures and the weakening rupee, but the overall sentiments on the street are expected to be optimistic in the near-term period. Short-term traders may keep their existing positions hedged to save themselves from global volatility,” Parakh told ET.

The Nifty index has shown signs of a short-covering rally after a brief correction, and technical analysis indicates a favorable outlook. The primary challenge lies in breaching the resistance level at 19,707, supported by a strong base at 19,225. The 200-day moving average at 18,650 provides a solid foundation for long-term prospects, further bolstering the current bullish trajectory of the Nifty, Prashanth Tapse of Mehta Equities notes.

Veteran investor Sanjiv Bhasin predicts that the Nifty will reach levels of 19,700-19,900 by Diwali, with the potential for new peaks by the end of the month.