This increase was contrary to expectations in the days leading up to the Budget that time was ripe for govt to cut long term capital gains tax (LTCG) for investors in stocks.

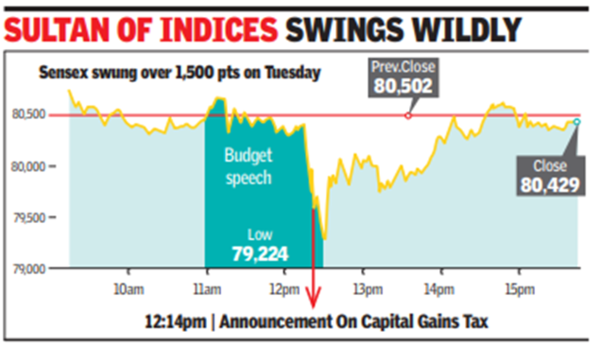

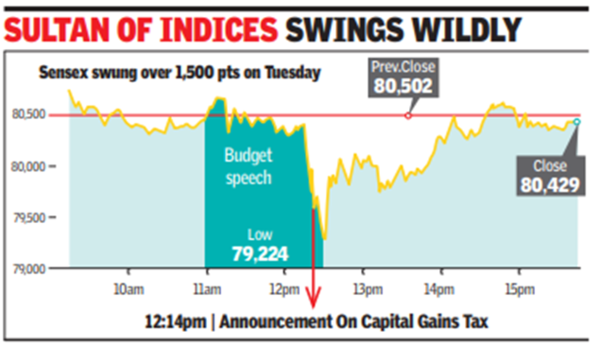

As a result, the sensex crashed nearly 1,550 points in Tuesday’s intraday trade but recovered soon enough to finally settle at 80,429 points, down just 73 points. On the NSE, Nifty 50 lost a little over 500 points to 24,074 but eventually closed at 24,479 – down 30 points.

“At a time when the equity indices are at an all-time high, govt has tried to take a share out of the growth and the profits earned by the investors from the capital market,” said Nilesh Sharma, president & executive director, Samco Securities. “It has imposed a double whammy kind of taxation by increasing both the STT rates on derivatives and an increase in STCG (short term capital gain) & LTCG,” he said.

The day’s trading pattern also led to heightened volatility with India VIX – the gauge for market’s gyrations – spiking to over 17%. Since June 4, when the Lok Sabha election results were announced, VIX was on a southward trend.

Top fund managers, however, believe that investors on the Street would soon start discounting the tax hike proposals and start focusing on other long-term factors. “While digesting the taxation changes, equity markets will shift focus back on earnings trajectory and other macroeconomic developments,” said Navneet Munot, MD & CEO, HDFC Mutual Fund.

Even as most leading indices closed flat, there was substantial action in stocks from select sectors that would either benefit from Budget proposals or be at a disadvantage. Jewellery stocks, for instance, rallied after the FM proposed to drastically cut import duty on gold, silver and platinum. “The reduction in basic customs duty on gold to 6% is expected to provide a fillip to gold jewellery sales, which have been tepid in the recent past because of high prices,” said Aditya Jhaver, director, Crisil Ratings. “This will drive up volumes for domestic gold jewellery retailers including during the festive and wedding seasons,” he added. Titan led the rally and closed 6.6% up while Kalyan Jewellers rose 4.5%, PC Jewellers (5%) and Senco Gold (4.8%).

In contrast, the FM’s proposal to do away with indexation benefits is expected to hurt the real estate sector the most and stocks from the sector crashed. “Removing the indexation benefit for long term capital gains taxation for non-financial asset could be a damper for the real estate sector, although taxed at a lower rate of 12.5% from 20%,” Mahaveer Jain, director & head (real estate sector) at India Ratings & Research, said.

Realty leader DLF closed 2.7% lower while Macrotech Developers (Lodha) closed 4.3% down, Godrej Properties was 3% lower and Sobha Developers closed a marginal 0.7% down. As a result of the slide in realty stocks, the sectoral index on BSE closed 2.2% lower.

Most FMCG stocks also rallied, led by ITC that was up 5.5%, and HUL which closed 1.2% up. Market players said Budget proposals that could boost income in the rural sector could lead to the much-awaited revival in rural demand, and in turn boost revenues and profits of FMCG companies.

On Tuesday, foreign funds led the selling with a net outflow of Rs 2,975 crore, while domestic institutions were net buyers at Rs 1,419 crore, BSE data showed.

At the close of Budget-day trading, investors were poorer by nearly Rs 1.9 lakh crore, with BSE’s market capitalisation now at Rs 459.1 lakh crore.