As the new scheme of taxation of buyback will apply only from Oct 1, companies may initiate buyback schemes at the earliest, to complete the process by Sept 30.

According to Abhishek Goenka, founding partner, Aeka Advisors: “The change on share buybacks is, unfortunately, not thought through. Taxing it as dividends with a capital loss benefits larger investors at the cost of smaller ones. Also, in many cases, buybacks are made out of share premium and, to tax such cases as dividends, goes against the scheme of dividend taxation.”

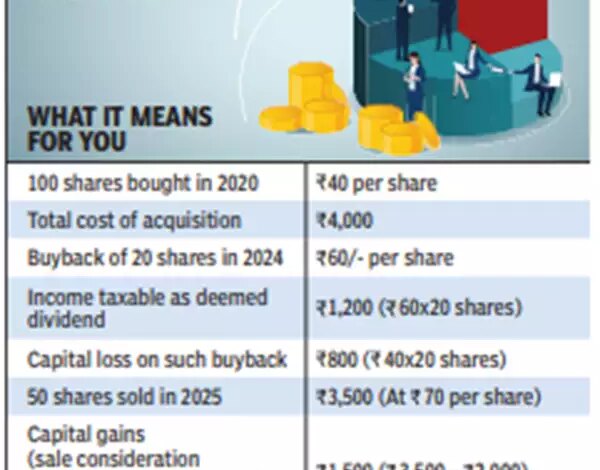

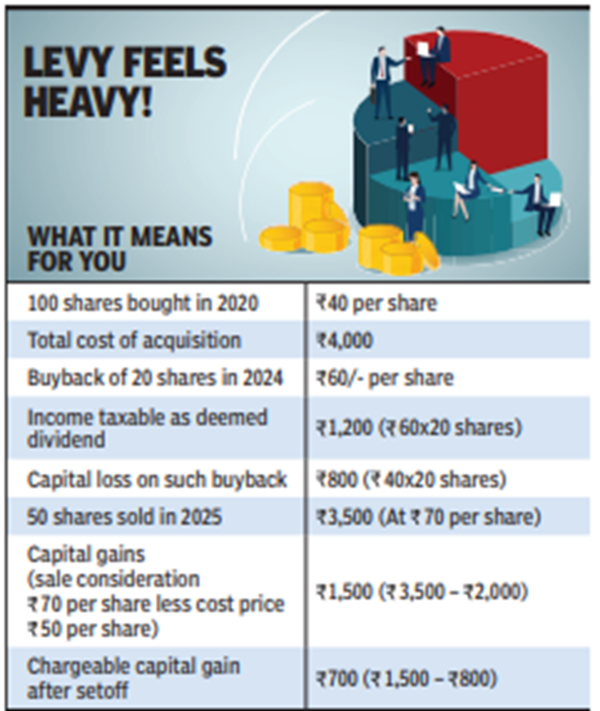

As Puneet Gupta, partner at EY-India, explains, the buyback proceeds will be taxable as dividend. However, the original cost of shares is treated as a capital loss to be adjusted against other capital gains, either in the same financial year or as a setoff over subsequent eight years. “This capital loss will be treated as long term or short term, depending on the duration of holding of the shares before buyback. Shares that are held for more than a year are treated as a long-term asset and the proposed rate is 12.5%,” says Gupta.

Now, if an investor incurs a long-term capital gain from any subsequent sale in the open market of the remaining shares or any other assets, the capital loss on buyback can be set off. “The impact is that the buyback proceeds are at first taxed as dividend as per the slab rate (which for many investors will be higher than the long-term capital gains tax rate). Second, on sale of the assets, the loss (on buyback) will be available for setoff only against capital gains, which are taxable at a lower rate. This is an anomaly,” adds Gupta.